Credit Repair Cloud Review: The Perfect Business to Start In 2025?

Today your credit score could be the most crucial figure that’s flying under your radar. As the financial scene becomes more intricate, countless people find themselves grappling with the trouble of bad credit. But here’s a thought: what if you could transform this widespread problem into a golden opportunity? Not only could you help others improve their credit, but you could also carve out your own entrepreneurial journey.

Introducing Credit Repair Cloud, an AI supported, people-driven solution to getting free of your job by building a crucial online business. It’s 2025, and the need for credit repair services has never been more pressing.

See why Credit Repair Cloud is considered the premier startup business model of the year. We’ll explore real-life transformation stories, highlight invaluable resources, and guide you through the features that we think make Credit Repair Cloud an unmatched startup business model.

If you want to check out CRC for yourself, you can click my referral link here and go straight to their page where they go into great detail about their features.

The Credit Crisis: Why Millions Are Struggling With Bad Credit

In today’s financial landscape, poor credit scores have become an alarmingly common issue. 🤯 A faulty credit report doesn’t just sit idly by; it actively affects millions of individuals striving for financial freedom.

Consider these implications:

- Loan Barriers: Obtaining a mortgage loan or any other credit line becomes an uphill battle.

- Increased Costs: Those with damaged credit face higher interest rates, making borrowing more expensive over time.

- Limited Opportunities: From renting apartments to securing a business loan, poor credit scores can significantly narrow prospects.

A damaged credit score doesn’t just lead to higher costs—it also restricts future possibilities. Taking action to resolve credit issues can unlock opportunities that once seemed unreachable.

With many caught in this credit dilemma, repair and proactive management have become essential for a more promising financial future. Ultimately, restoring credit is more than just correcting figures; it’s about taking back control of your financial destiny.

Have You Been Ignoring Your Credit Score? You’re Not Alone

Ignoring your credit score can significantly impact your financial future. Poor credit isn’t just about facing high-interest rates; it can also create substantial obstacles in securing housing and limit your financial opportunities.

Here’s a quick rundown of the long-term effects:

- Financial Stress: Higher interest rates on loans mean more of your income is siphoned off to debt payments.

- Housing Challenges: Many landlords review credit scores, so low scores can hinder your ability to rent an apartment.

- Emotional Impact: The burden of debt and financial pressure can strain relationships and cause anxiety.

| Impact of Poor Credit | Consequence |

|---|---|

| Difficulty obtaining loans | Limited access to crucial financial resources |

| Higher interest rates | Increased borrowing costs |

| Limited rental and job opportunities | Stagnated personal and financial growth |

Even if you don’t have bad credit, there’s plenty of people who do! CRC offers a unique opportunity to start a business regardless of your own credibility, technical capabilities, and helps you develop a business that makes financial freedom a reality.

Here’s some success stories about how people changed their own lives while helping others at the same time! 🙂

How Entrepreneurs Have Transformed Their Life with CRC & How You Can Do The Same!

There’s a powerful saying from a guy named T. Harv Eker: “Struggle is optional.”

I’ll never forget that quote as long as I live. There are so many people I know who go through their day not realizing what a gift it is to be able to experience life. Understanding the difference between good debt, bad debt, financial leverage, and the empowerment of financial freedom is key to taking control of your destiny.

Most people started using CRC and got their start with the Credit Challenge, or bolted-on CRC to an existing credit company that had started. Either way, the results speak for themselves. They followed simple principles that CRC outlines:

- They identified that they needed to have a business in a growing and established industry that Helps people.

- They showed up and went through the training. They didn’t make excuses, they took action and didn’t stop until they saw the results they knew were possible.

- They repeated the process until they had reached heights that others only dream.

Speaking from experience here, if you are working a 9-5 with overtime and weekends, you simply don’t understand what a life-changing experience it is to set your own schedule, control the amount of money you make, and the schedule on your calendar.

CRC is by far my favorite system to start because it fundamentally is doing exactly what every entrepreneur should do. Work in an essentially needed industry, help people solve major problems, and get recurring revenue by building a client base.

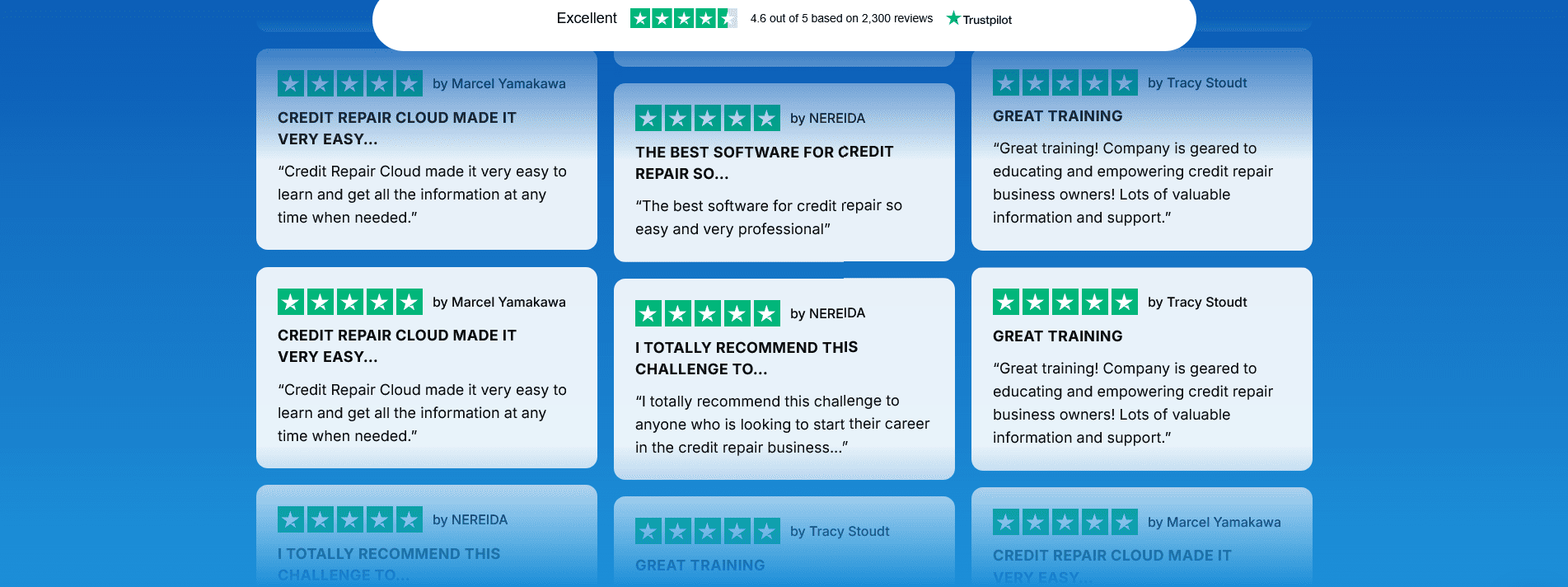

What Other Entrepreneurs Are Saying: Testimonials

There are thousands upon thousands of positive reviews about CRC. TrustPilot alone has a 4.6 out of 5 stars!

Establishing a business can be daunting, but armed with the right tools and community, many find success more attainable. That’s where CRC shines, offering not just a software solution but a thriving environment for entrepreneurs to flourish.

Many people have shared amazing positive testimonials! Fueled by innovation, determination, and the unparalleled support of the Credit Repair Cloud community. Success stories abound from individuals who have transformed not just their careers, but also their lives and the lives of many others through credit repair services.

User Collaboration and Shared Growth

One of the often-overlooked advantages of using Credit Repair Cloud is the vibrant community that comes with it. This collective, often active across various social media platforms, offers newcomers a wealth of knowledge and seasoned expertise.

Sarah, a recent addition to this community, shares how invaluable the support has been. She recalls a particular situation where a complex credit report challenge was easily solved after a quick exchange with a fellow Credit Hero in the forum.

These interactions go beyond just swapping strategies; they’re about growing together and creating a space where team wins are just as exciting as personal milestones. In an industry where staying informed and having support is crucial, the CRC community is a rock-solid foundation for entrepreneurs to keep thriving.

Unlock Your Potential: Start Your Credit Repair Business Today!

Credit Repair Cloud stands as a beacon for aspiring entrepreneurs in 2025. With the rising market value of credit repair and the increasing need for enhanced credit scores, there’s no better time to dive into this industry. CRC offers a user-friendly platform tailor-made for people just getting started.

In essence, CRC is more than software. It’s your partner in unlocking a profitable business model with a consistent client base. With the demand for credit repair services at an all-time high, your potential today is limitless.

Core Features & More 💪

Starting a business in the credit repair field can be exciting, but having the right tools at your fingertips is crucial. That’s where Credit Repair Cloud comes into play with a suite of features tailored for entrepreneurs who are just getting their feet wet. These features help you streamline credit repair processes, making your operations more efficient and productive. Think of it as having a reliable toolkit always by your side, ready to tackle the day-to-day challenges of running a new venture.

Credit Repair Cloud doesn’t just offer practical solutions; it provides the strategic support you need to lay a solid in the the competitive world of credit repair.

Educational Resources: Podcasts, Books, and Masterclasses

Strong educational resources can make all the difference when starting and growing your business, and Credit Repair Cloud certainly delivers on this front. They offer an impressive array of tools including podcasts, books, and masterclasses designed to help you develop from a beginner into a credit repair pro.

Podcasts are perfect for those who like to learn on the go. Whether you’re commuting or relaxing after a busy day, you can listen to insights on industry trends and get valuable business tips in small, manageable chunks. Books, on the other hand, provide a deeper dive into the world of credit repair, offering detailed, step-by-step strategies for success.

For those who thrive on interaction, masterclasses provide a dynamic learning environment where you can engage with experts and explore advanced skills and tactics necessary for the field. Altogether, these resources form a robust educational foundation, empowering you to effectively build and expand your credit repair business.

Intuitive Interface

An intuitive interface is the backbone of productivity, and Credit Repair Cloud provides just that. Imagine navigating your business dashboard as effortlessly as scrolling through your favorite social media app. Simplicity and efficiency are at the core of this well-designed interface, making it superbly easy for startups to hit the ground running.

The seamless dashboard allows you to manage everything from client interactions to credit report disputes without a hitch. This fluid navigation means less time grappling with software and more time focusing on what truly matters—helping clients improve their credit scores. As many would agree, ease of use is key to ensuring your business dreams turn into reality without a hitch.

CloudMail Capabilities

In a digital age where communication is key, CloudMail emerges as a gamechanger for new startups. Completing the suite of features offered by Credit Repair Cloud, this powerful mailing system integrates effortlessly into your business, positioning you leagues ahead of competitors.

CloudMail automates the sending of dispute letters to credit bureaus, thus accelerating the credit repair process. With this capability at your fingertips, you can maintain a high level of service efficiency, fostering satisfaction and trust with your clients. By automating such essential tasks, your focus can remain on growing your client base and elevating your service delivery—two critical components for skyrocketing your business success.

CreditScore Hero Integration

Elevating a startup isn’t just about having big dreams; it’s about having the right tools to make those dreams a reality. That’s where CreditScore Hero integration comes into play. This powerful feature enhances your business by giving clients real-time access to their credit scores.

It’s all about empowerment—clients get the updates they need to understand their credit health instantly, while your business gains credibility as a reliable ally in their financial journey. This transparency not only increases the value of your service but also keeps clients actively involved, making your business a key player in their financial planning.

With this tool, you’re not just improving client satisfaction; you’re building lasting relationships and shaping a successful business future.

Peer and Mentor Networking Opportunities

No entrepreneur should go it alone, and Credit Repair Cloud gets that in a big way. Building a solid network of peers and mentors could be the secret ingredient to turning your startup into a booming business. These connections are more than just contacts—they’re your sounding board, offering fresh ideas, advice, and chances to collaborate.

With resources such as webinars, online forums, and community events from CRC, you’re not just networking; you’re joining a group united by shared goals and collective learning.

These relationships could lead to partnerships, joint ventures, and a deeper understanding of the industry landscape. Whether you’re on the hunt for a mentor or eager to share experiences with fellow entrepreneurs, the connections you make here are sure to be invaluable assets in your path to success.

Pricing Structure and Flexibility

Credit Repair Cloud’s appeal isn’t just in its powerful software. Their pricing plans are smartly designed to cater to everyone. From beginners just starting to explore the credit repair industry, to seasoned entrepreneurs running full-scale operations.

But let’s be real: not all plans are created equal. The “Personal” tier might look attractive because it’s cheaper, but it probably won’t give you all the tools you need to run a booming business in 2025.

If you’re serious about scaling up, you might want to consider the “Start” tier or higher. Why does this matter? Well, picking a plan that lets you integrate with tools like Zapier and other APIs is a game-changer.It helps you keep everything organized and automate tasks like following up with clients or managing dispute letters. Sure, it might cost more upfront, but think of it as an investment in efficiency that pays off down the road. By using these advanced tools, you’re not just keeping up with the competition—you’re leaving behind those who are still stuck doing everything manually.

Automating Credit Repair

Using automation tools with CRC can transform your credit repair business into a well-oiled machine. Picture this: tasks that were once piling up, clients eagerly waiting for updates, and disputes with bureaus that need addressing, all magically handled while you focus on growing your business.

This seamless teamwork with Credit Repair Cloud opens the door to becoming a hero in the eyes of your clients, efficiently managing their credit needs without feeling overwhelmed. A software’s capability to automatically generate updates and tasks turns the whole credit repair process into a streamlined and effective system. When you choose a plan that includes integrations, you’re not just saving time; you’re also putting your business in prime position for steady growth.

As new clients come in, the automated features make sure they get timely communication and personalized credit repair services, which helps grow your client list with ease. This game-changing tool elevates your business model and operations, showing just how ready the credit repair industry is for innovation. Being equipped with these automation tools not only puts you ahead of the competition but also makes efficiency a must-have rather than just a nice-to-have.

You’re not simply juggling tasks; you’re crafting an engaging and time-saving experience for your clients. This ensures they stick with you long after their initial credit check-up.

Take Action Now: Your Future Awaits!

In today’s world of financial services, Credit Repair Cloud (CRC) really is a great opportunity for anyone looking to dive into the thriving credit repair industry. If you’re tired of working for someone else and want a slice of this booming market, starting a business with CRC could be just what you’re looking for. The demand for credit repair is on the rise because more and more people are eager to boost their credit scores — and that’s where you can make a difference. So, why consider Credit Repair Cloud for your business venture?

Here are the primary compelling reasons you should start today:

**Easy-to-Use Software**

With its intuitive layout and essential features, CRC makes managing the credit repair process straightforward and efficient.

**Proven Success Stories**

Many aspiring business owners and startups have already used this platform to make significant improvements in credit scores and positively impact lives.

**Endless Storage & Communication**

Easily manage your client base and fine-tune your marketing efforts to reach potential new clients effectively.

With how fast you can get started with this, we absolutely recommend signing up now, and access resources designed to launch your startup on hyper-speed!

Financial independence doesn’t have to be complicated, choose a simpler system and help change people’s lives today!